utah solar tax credit form

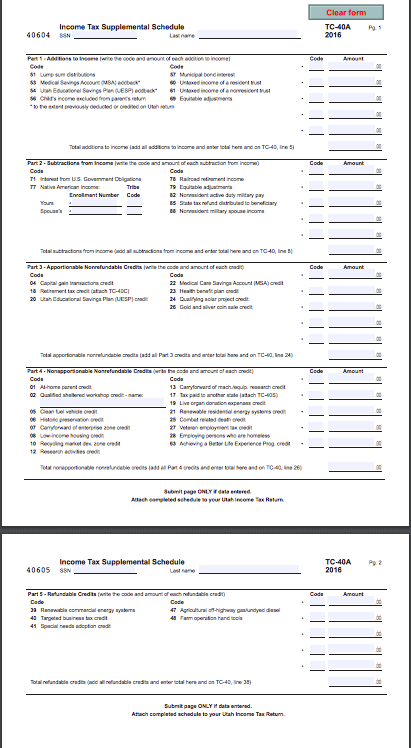

You can receive a maximum of 1000 credit for your purchase. It involves filling out and submitting the states TC-40 form with your state tax returns.

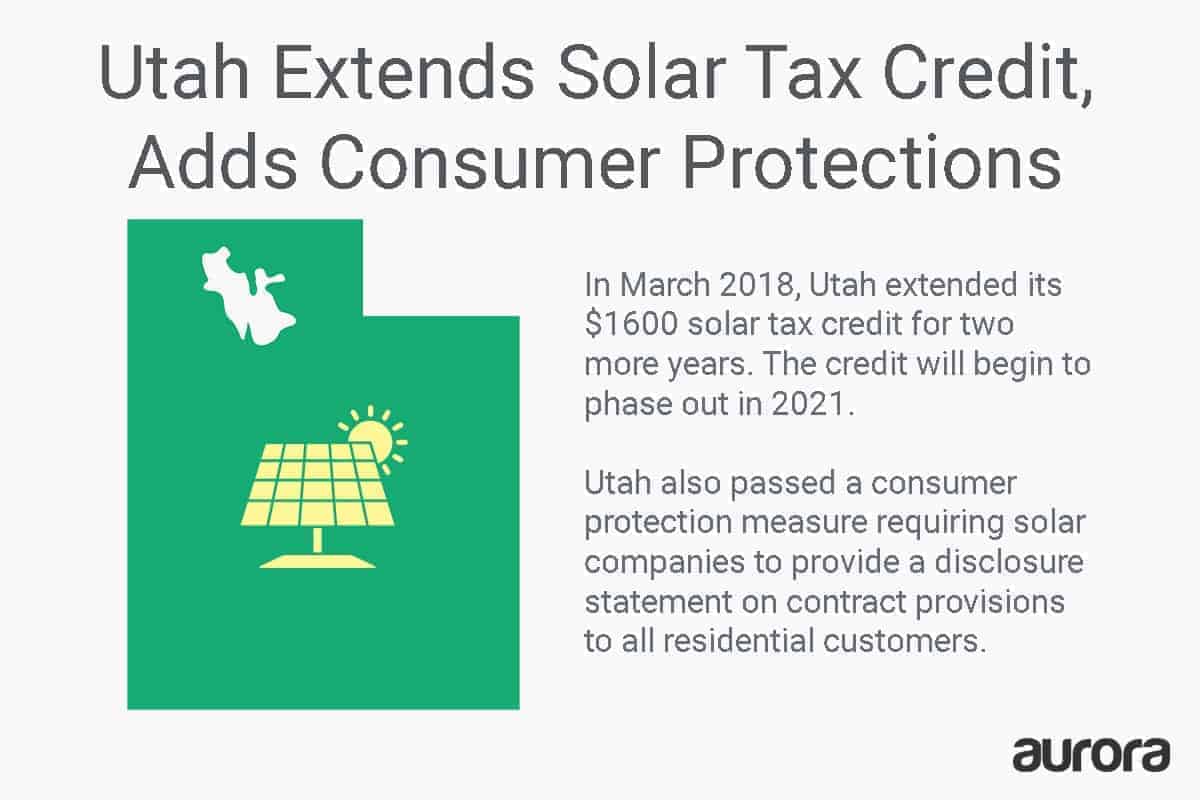

The 2018 State Solar Policy Changes You Need To Know Aurora Solar

There is no tax credit on solar panels that you.

. Renewable Energy Systems Tax Credit Application Fee. Utah has a Solar Tax Credit of 25. Here are the general criteria to be eligible for the solar tax credit.

The process to claim the Utah renewable energy tax credit is actually relatively simple. 12 Credit for Increasing Research Activities in Utah. Utahgov Checkout Product Detail.

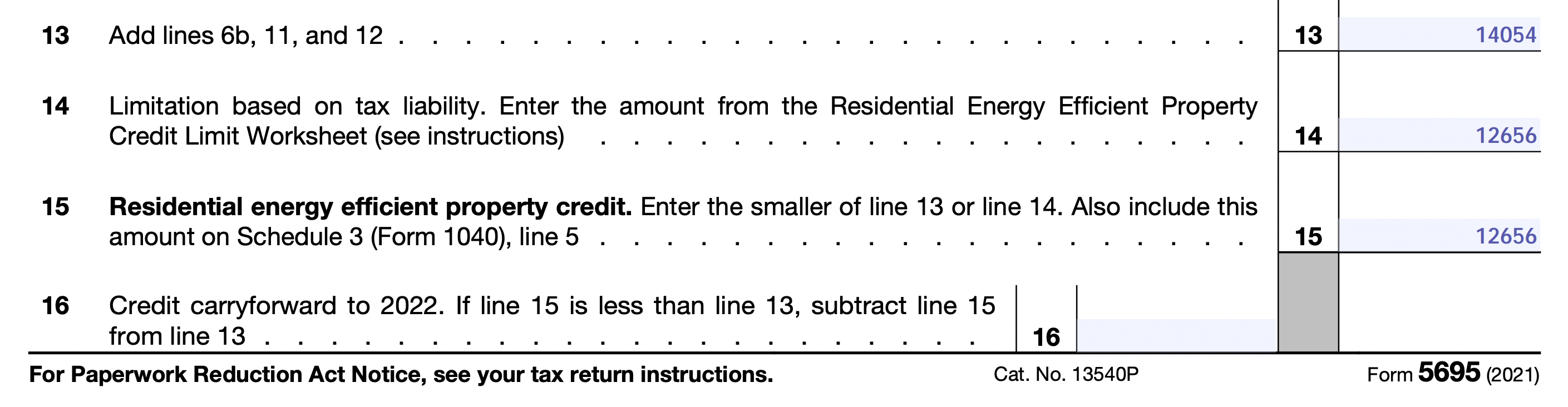

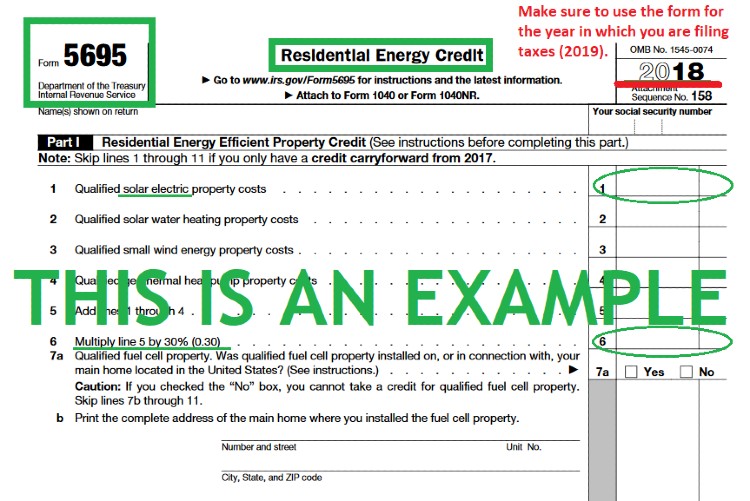

The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects. This form is provided by the Office of. To claim your federal tax credit you are required to complete IRS Form 5695 when lodging your tax return.

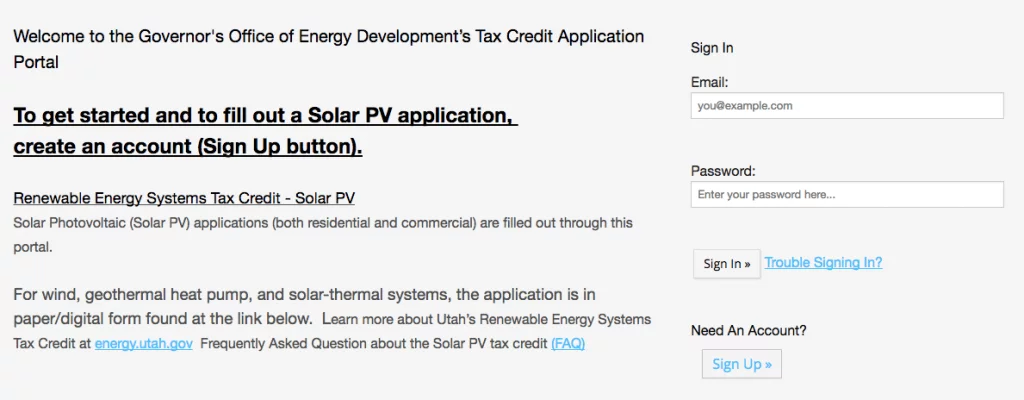

Everyone in Utah is eligible to take a personal tax credit when installing solar panels. A Secure Online Service from Utahgov. Utah homeowners have access to the Utah Renewable Energy Systems Tax Credit which is the state solar tax credit.

We are accepting applications for the tax credit programs listed below. 17 Credit for Income Tax Paid to Another State. The Utah tax credit for solar panels is 20 of the initial purchase price.

Welcome to the Utah energy tax credit portal. Utahs solar tax credit makes going solar easy. Log in or click Register in the upper right corner to get started.

The credit is being. The Alternative Energy Development Incentive AEDI is a post-performance non-refundable tax credit for 75 of new state tax revenues including state. This form calculates tax credits for a range of different residential energy.

The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. The solar panel system must be installed between Jan 2006 and December 31 2023.

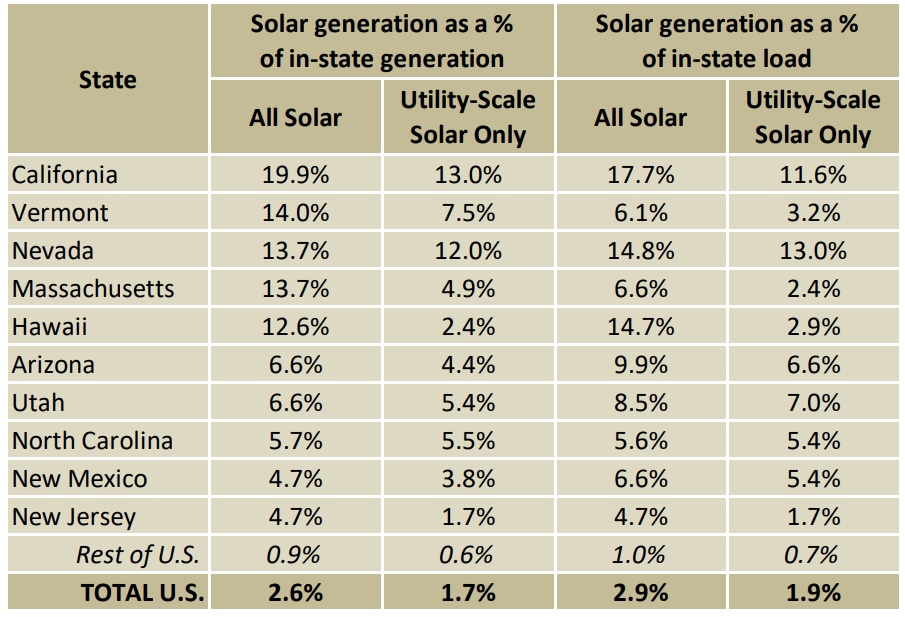

51 rows Energy Systems Installation Tax Credit. The credit is for 25 of your total system cost up to a. Under the Amount column write in 1600.

1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. Application fee for RESTC. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research.

Faqs Utah Net Metering And Solar Incentives

Solar Incentives For Utah Homes Utah Energy Hub

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Tc 40e Fill Out Sign Online Dochub

Filing For The Solar Tax Credit Wells Solar

Congress Passes 30 Energy Tax Credit Harness The Power Of The Sun With Hedgehog Electric Solar St George News

Qualifying For Solar Tax Credits Federal State Blue Raven Solar

Understanding The Utah Solar Tax Credit Ion Solar

Solar Incentives For Utah Homes Utah Energy Hub

Utah Solar Tax Credits Blue Raven Solar

After 10 Years This Utah Alternative Energy Tax Credit Has Yet To Pay Out Any Money

Federal Solar Tax Credits Incentives

Solar Panel Installation Tax Credits Intermountain Wind Solar

Colorado Solar Tax Credit And Incentives 12 Things You Should Know

2022 Solar Incentives And Rebates Top 10 Ranked States